Global banks’ market capitalization recovers to almost pre-pandemic levels

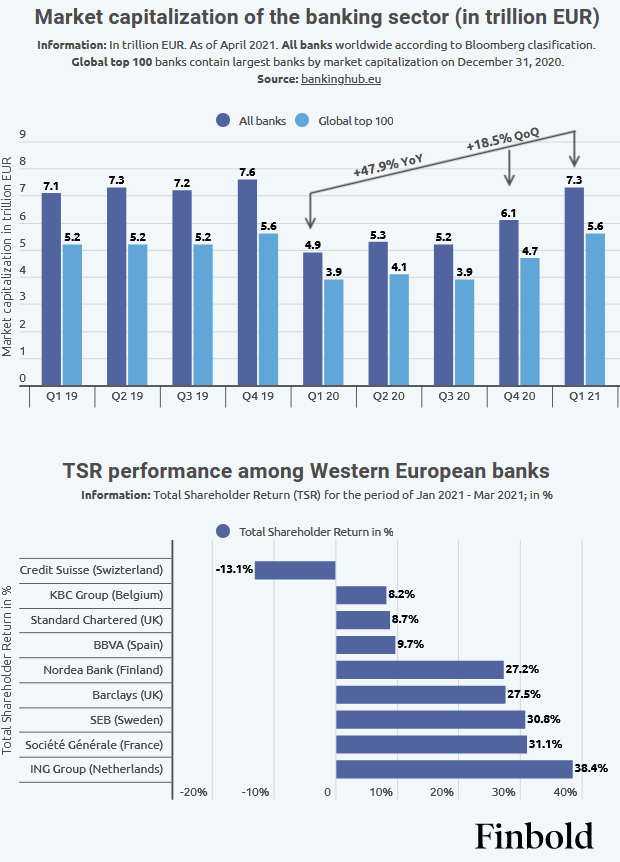

Data acquired by Finbold indicates that the market capitalization of all global banks has increased 47.9% between Q1 2020 and Q1 2021 from €4.9 trillion to €7.3 trillion. Between the last quarter of 2020 and Q1 2021, the market cap surged 18.5%.

A5 NEWS – Elsewhere, the top 100 banks worldwide have recorded a 43.5% increase in capitalization between Q1 2020 to Q1 2021 from €3.9 trillion to €5.6 trillion. Elsewhere, between the last quarter of 2020 and Q1 2021, these banks recorded a 19.1% increase in market cap.

Policy changes spark banking sector recovery

The report focuses on some of the measures that have helped banks embark on a recovery mode. According to the research:

“The recovery has been aided by policy changes that offered a base for resurgence to pre-pandemic levels. Amid the crisis, governments stepped in with massive stimulus packages that cushioned banks from further decline in market capitalization. Notably, the losses could have been much higher were it not for central banks’ initiatives to ease restrictions on liquidity and capital.”

Furthermore, the total shareholder return for Western European banks between January 2021 and March 2021 shows that ING Group from the Netherlands is the biggest gainer at 38.4%, followed by France’s Société Générale at 31.1%. Sweden’s SEB emerged fourth with returns of 30.8%, followed by the UK’s Barclays at 27.5%. Nordea Bank from Finland recorded TSR returns of 27.2.

Other banks with notable returns include Spain’s BBVA (9.7%), UK’s Standard Chartered (8.7%), and Belgium’s KBC Group (8.2%). Among the selected banks, Switzerland’s Credit Suisse recorded the worst returns at -13.1%.

The pandemic has resulted in a shift in consumer behavior, and the report explains how banks managed to incorporate the changes in their operations. The report notes that:

“The recovery has also been inspired by the bank’s ability to adapt to the crisis that confined most people in their homes. Lending institutions leveraged digital tools to continue running normal operations. The digital shift has further strengthened the banks as more consumers were willing to utilize the online forms of banking. However, the shift has elevated competition between banks and already established fintech firms.”

Moving forward, banks need to focus on meeting the changing consumer demand to sustain the recovery process.

Facebook Comments Box

![Le chocolatier suisse Läderach développe une histoire d’amour avec la Chine [ INTERVIEW ]](https://www.afrique-54.com/wp-content/uploads/2023/12/Johannes-Laderach-et-chocolat-e1702548585357-218x150.jpg)